how much tax is taken out of my paycheck in san francisco

The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the.

Are S F Landlords Sitting On Tens Of Thousands Of Empty Homes Vacancy Tax Could Put Debate To Rest

The California bonus tax percent calculator will tell.

. Yes residents in California pay some of the highest personal income tax rates in the United States. You can leave your heart in San Francisco and when you work anywhere in California you leave a big chunk of your pay behind to taxes. Paycheck Calculator Calculates net pay or take home pay for salaried.

27 rows These are contributions that you make before any taxes are withheld from your paycheck. Ad Payroll So Easy You Can Set It Up Run It Yourself. Just enter the wages tax withholdings and other information required.

The payroll tax modeling calculators include federal state and local taxes and benefits and other deductions. The federal income tax has seven tax rates for 2020. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

FICA taxes consist of Social Security and Medicare taxes. If you make 55000 a year living in the region of California USA you will be taxed 11676. See how your refund take-home pay or tax due are affected by withholding amount.

Use this tool to. 27 rows So if your income is on the low side youll pay a lower tax rate than you likely would in a. Normally 62 of an employees gross pay is taken out for this purpose and another 62 is paid by the employer.

The income tax rate ranges from 1 to 133. Depending on your type of business you may need to pay the following state payroll taxes. Are California residents are subject to personal income tax.

This California bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. The amount of federal income tax. California unemployment insurance tax.

To find out how much personal. Youll pay this state unemployment insurance tax on. For a single filer the first 9875 you earn is taxed at 10.

How old are you. Taxpayers can choose either itemized deductions or. Your take-home from a 100000.

Only the very last 1475 you earned. Subject to State Disability Insurance SDI has standard deductions. Estimate your federal income tax withholding.

However they dont include all taxes related to payroll. That means that your net pay will be 43324 per year or 3610 per month. Use ADPs California Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

All Services Backed by Tax Guarantee. During the deferral period lasting through December 31. FICA taxes are commonly called the payroll tax.

Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax. No local income tax. 91 rows Brief summary.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

Do Puerto Ricans Pay Federal Taxes And Contribute To The Us Economy Marca

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

Do I Have To Pay Taxes On Proceeds From My Garage Sale

9 Things New Parents Need To Know Before Filing Their Taxes In 2020

Aaron Peskin Aaronpeskin Twitter

After Tax Salary In San Francisco Ca Comparably

Jose Cisneros Treasurersf Twitter

Property Tax California H R Block

As Rideshare Prices Skyrocket Uber And Lyft Take A Bigger Piece Of Riders Payments Mission Local

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

2022 2023 Federal Income Tax Brackets Tax Rates Nerdwallet

:max_bytes(150000):strip_icc()/buying-vs-renting-san-francisco-bay-area-ADD-V2-d0efaf2b7ac346bbba2c1ac389751ef1.jpg)

Buying Vs Renting In San Francisco What S The Difference

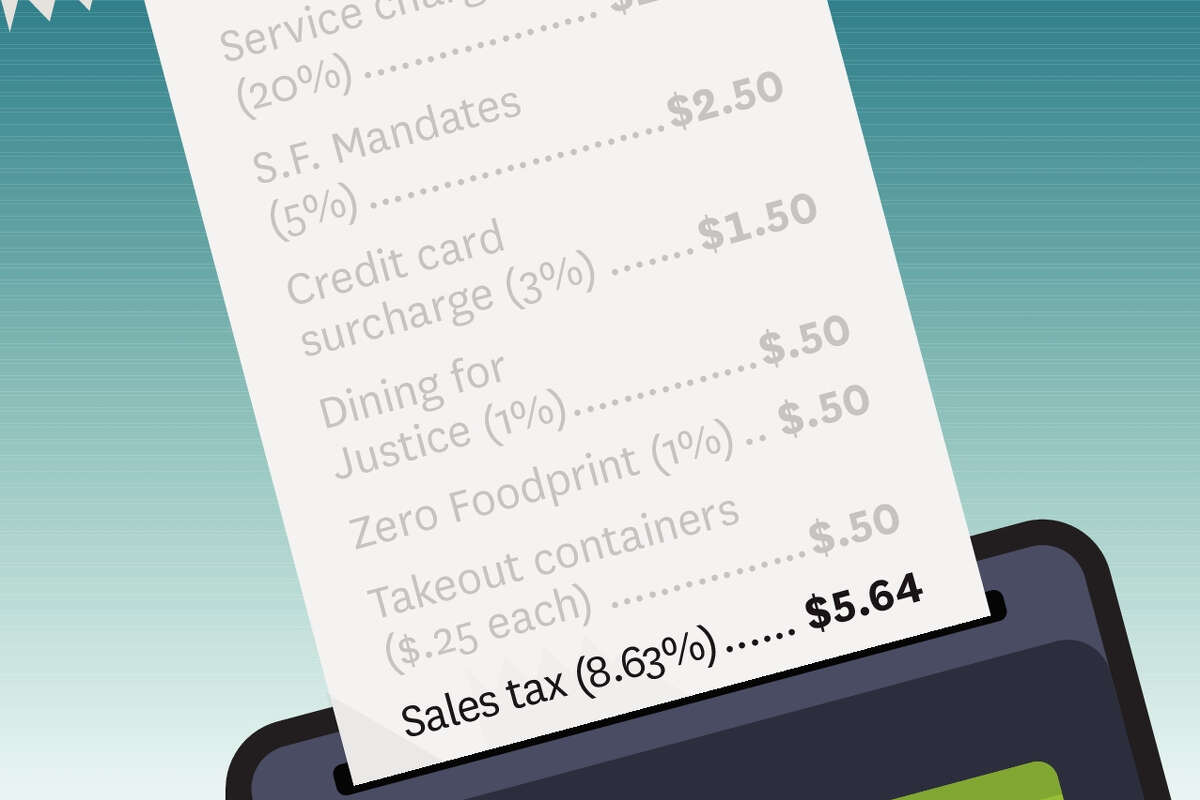

Did You Pay Way More At A Restaurant Than You Expected Here S How Bay Area Surcharges Work

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Local Income Taxes In 2019 Local Income Tax City County Level

How Much Are You Paying In Taxes And Fees For Gasoline In California The San Diego Union Tribune